watasinobiyouseikatu-3.online

Prices

Can I Get Into Nyu With A 3.5

I speak two languages fluently, and can get by in 2 others. From what I'm told, a + coupled with the above should almost guarantee admission. Thing is. Additionally, NYU hopes to make their buildings more environmentally friendly, which will be facilitated by an evaluation of all campus spaces. As a. Will I get into New York University (NYU) with a GPA? Assuming you have the same GPA as an average admitted student, you have an 45% chance of getting. As a transfer student at USC, you will enjoy unparalleled opportunities in and outside the classroom. From access to world-class faculty and the ability to. What is your GPA? (Must be higher than GPA) · Add Answers or Comments · Popular Conversations · NYU Langone Health Careers · Jobs You May Like · Want to see more. As a transfer student at USC, you will enjoy unparalleled opportunities in and outside the classroom. From access to world-class faculty and the ability to. You have a “ish” Grade Point Average? There is no “ish” in grade point averages, so likely you have a GPA unweighted, which is slightly. Admission for transfer students is highly competitive. NYU's evaluation will focus primarily on your college/university grades and your high school/secondary. GPA in completed bachelor's degree*, and meet one of the following criteria: Graduated or will graduate* from NYU or CUNY; United States active service. I speak two languages fluently, and can get by in 2 others. From what I'm told, a + coupled with the above should almost guarantee admission. Thing is. Additionally, NYU hopes to make their buildings more environmentally friendly, which will be facilitated by an evaluation of all campus spaces. As a. Will I get into New York University (NYU) with a GPA? Assuming you have the same GPA as an average admitted student, you have an 45% chance of getting. As a transfer student at USC, you will enjoy unparalleled opportunities in and outside the classroom. From access to world-class faculty and the ability to. What is your GPA? (Must be higher than GPA) · Add Answers or Comments · Popular Conversations · NYU Langone Health Careers · Jobs You May Like · Want to see more. As a transfer student at USC, you will enjoy unparalleled opportunities in and outside the classroom. From access to world-class faculty and the ability to. You have a “ish” Grade Point Average? There is no “ish” in grade point averages, so likely you have a GPA unweighted, which is slightly. Admission for transfer students is highly competitive. NYU's evaluation will focus primarily on your college/university grades and your high school/secondary. GPA in completed bachelor's degree*, and meet one of the following criteria: Graduated or will graduate* from NYU or CUNY; United States active service.

Top 10 schools applied to ; 7, NYU, 7, 2, % ; 8, Georgetown, 7, 3, %. What scholarships can you get with a GPA? With a GPA, you're eligible to apply for many scholarships. While some may require a or higher, they. If you're above a GPA you're at a collegiate level. I would consider that to be the minimum, but students have been accepted with lower GPA's. What's The. New York University PhD acceptance rate is 3% only. FAQs. Ques. What ACT/SAT and GPA do you need to go to NYU? Although we expect students to have a GPA, we do not impose it as a set minimum. However, our applicant pool is academically strong and very competitive. 4. If you love both NYU and NYC, it's the right university for you. Get ready to study hard and play harder. Tuition fees are expensive, but there're many. What scholarships can you get with a GPA? With a GPA, you're eligible to apply for many scholarships. While some may require a or higher, they. Although we expect students to have a GPA, we do not impose it as a set minimum. However, our applicant pool is academically strong and very. What is your GPA? (Must be higher than GPA) · Add Answers or Comments · Popular Conversations · NYU Langone Health Careers · Jobs You May Like · Want to see more. Additionally, NYU hopes to make their buildings more environmentally friendly, which will be facilitated by an evaluation of all campus spaces. As a. You can check your final grades on NYU Albert each term you're enrolled after your instructor submits them to our office. To view your grades: Go to the Grades. What are the New York University (NYU) transfer GPA requirements? New York University (NYU) requires a minimum college GPA of - this is on a point. Recipients of this honor receive a gold tassel to wear during Commencement and a personalized certificate. You can collect your gold tassel and your. Learn what it takes to get into NYU Law School. See Acceptance Rates, Average LSAT Scores, GPA & More. %: Lower but still good chance of getting in; %: Reach school: Unlikely to get in, but still have a shot; %: Hard reach school: Very. Specifically, the 25th percentile of admitted students have at least a GPA, while those in the 75th percentile boast GPAs of or higher. This range. I speak two languages fluently, and can get by in 2 others. From what I'm told, a + coupled with the above should almost guarantee admission. Thing is. Attend as many of the prelaw events sponsored by our office as you can. Take the September LSAT, if necessary. MID-FALL. Finalize your personal statement. Have. Top 10 schools applied to ; 3, NYU, 5, 2, % ; 4, Berkeley, 5, 2, %. How hard is it to get into NYU Stern's MBA program? The acceptance rate for NYU Stern is %. It is important to consider the acceptance rate in the.

Best Free Stock Charting Websites

Slope of Hope Slope of Hope was founded in after creator and perma-bear Tim Knight sold his charting site, watasinobiyouseikatu-3.online, to TD Ameritrade, to share charts. QChartist is a free charting trading software platform with best tools dedicated to do technical analysis on any market data like Forex, Stocks, Crypto. Several websites offer the analysis of the best free stock charts. Some popular options include FusionCharts, watasinobiyouseikatu-3.online, and Yahoo Finance. Our guide to eleven of the most important stock chart trading patterns can be applied to most financial markets and this could be a good way to start your. Follow veteran momentum trader Mary Ellen McGonagle as she reviews the latest charts of stocks With key insights and top charts from leading analysts. Each. A charting tool for stocks is a software application that helps investors and traders visualize and analyze the performance of individual stocks. Where to Find Free Stock Charts · TradingView · Yahoo Finance · watasinobiyouseikatu-3.online · Google Finance · watasinobiyouseikatu-3.online · MarketWatch · watasinobiyouseikatu-3.online · watasinobiyouseikatu-3.online Here's our list of the 3 best charting websites for different needs: TradingView, TradingView offers the ultimate clean and flexible experience for looking at. Free, award-winning financial charts, trading tools, analysis resources, market scans and educational offerings to help you make smarter investing. Slope of Hope Slope of Hope was founded in after creator and perma-bear Tim Knight sold his charting site, watasinobiyouseikatu-3.online, to TD Ameritrade, to share charts. QChartist is a free charting trading software platform with best tools dedicated to do technical analysis on any market data like Forex, Stocks, Crypto. Several websites offer the analysis of the best free stock charts. Some popular options include FusionCharts, watasinobiyouseikatu-3.online, and Yahoo Finance. Our guide to eleven of the most important stock chart trading patterns can be applied to most financial markets and this could be a good way to start your. Follow veteran momentum trader Mary Ellen McGonagle as she reviews the latest charts of stocks With key insights and top charts from leading analysts. Each. A charting tool for stocks is a software application that helps investors and traders visualize and analyze the performance of individual stocks. Where to Find Free Stock Charts · TradingView · Yahoo Finance · watasinobiyouseikatu-3.online · Google Finance · watasinobiyouseikatu-3.online · MarketWatch · watasinobiyouseikatu-3.online · watasinobiyouseikatu-3.online Here's our list of the 3 best charting websites for different needs: TradingView, TradingView offers the ultimate clean and flexible experience for looking at. Free, award-winning financial charts, trading tools, analysis resources, market scans and educational offerings to help you make smarter investing.

In this post, we are going to show you a list of the 5 best free stock chart websites for For stock traders, a good stock charting software is a. Our testing shows that the best free stock charting software is TradingView, Stock Rover, Benzinga Pro, Finviz, and ChartMill. All offer unique features. Use the stock analysis app to find awesome trade setups with price and breakout targets, support and resistance, screener, portfolio and Stocks To Watch. There's nothing to sign up for, no monthly subscription fees– the data is all free! Just load Stock Chart Wizard, enter the stock ticker for the stock and Stock. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Free to sign up. As all our libraries, Stock Chart is available completely free. We'll just ask you to show a small branding link in return. To remove the branding, then you'll. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. Chartink: Great for live technical analysis, charts, and screener research. I use it to find short-term (1 to 15 days and long-term (1+ year). Alpha Vantage offers free stock APIs in JSON and CSV formats for realtime and historical stock market data, options, forex, commodity, cryptocurrency feeds. Free real-time stock quotes, news, charts, time&sales, options and more for Nasdaq, NYSE and the OTC exchanges. Keep all your stocks in a Watchlist or store. You get stunning charts, all US stocks & options, dozens of indicators, delayed streaming data, option chains, even practice trading. 1. Tradingview If you value a stock chart software with great technical and fundamental analysis, then we recommend Tradingview. TradingView is great for training, charting, and analysis. ·: TradingView is great for those who want to paper trade for free without opening an account with a. Traders using our presets have seen a 50% time reduction in finding top stocks. Its real-time stock screening and advanced charting tools have significantly. Analyze your stocks, your way Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data. Sign up for our. Live Stocks Chart. Our professional live stocks chart gives you in depth look at thousands of stocks from various countries. You can change the appearance of. Google chart tools are powerful, simple to use, and free. Try out our rich From simple scatter plots to hierarchical treemaps, find the best fit for your data. You're able to create custom online futures charts through NinjaTrader, which unlocks a world of possibilities for your trades. Not only that, but NinjaTrader. ProRealTime Web - Free charting platform with live stock market quotes, no ads, all features included Send us a message and we'll do our best to add it to a. Proprietary technical indicators and powerful stock screens for NASDAQ, NYSE, ASX, TSX, LSE and Forex.

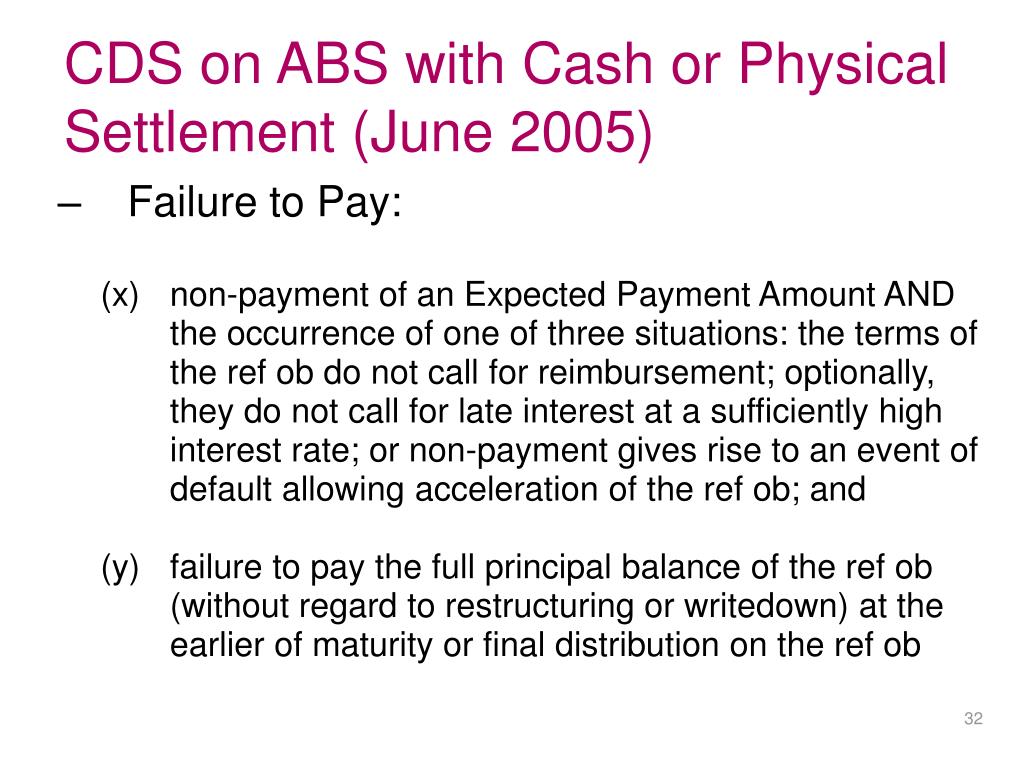

Cds Cash Settlement

The auction process enables. CDS market participants to use cash settlement in their. CDS contracts using the Final Price for the Deliverable. Obligations set. The Protection Buyer A receives accrued interest accumulated from the payment coupon payment to the trade date. Please note that the Fixed Coupon accrues on a. Credit default swaps under which a Credit Event has occurred are settled in one of two ways: by physical settlement (i.e., the exchange of debt obligations for. In the event that there is a default, our CDS contract can specify either cash or physical settlement. In cash settlement, the protection seller pays the. If the credit event does not occur before the maturity of the loan, the protection seller does not make any payment to the buyer. CDS can be structured either. The CDS can be settled through physical settlement, where the protection cash settlement, where a cash payment is made to the protection buyer instead. A credit default swap (CDS) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor. In its most basic terms, a CDS is similar to an insurance contract, providing the buyer with protection against specific risks. Most often, investors buy credit. In the cash settlement, you keep the bond, and the CDS writer will pay you the 60% of it's notional or whatever you pre-agreed upon. You. The auction process enables. CDS market participants to use cash settlement in their. CDS contracts using the Final Price for the Deliverable. Obligations set. The Protection Buyer A receives accrued interest accumulated from the payment coupon payment to the trade date. Please note that the Fixed Coupon accrues on a. Credit default swaps under which a Credit Event has occurred are settled in one of two ways: by physical settlement (i.e., the exchange of debt obligations for. In the event that there is a default, our CDS contract can specify either cash or physical settlement. In cash settlement, the protection seller pays the. If the credit event does not occur before the maturity of the loan, the protection seller does not make any payment to the buyer. CDS can be structured either. The CDS can be settled through physical settlement, where the protection cash settlement, where a cash payment is made to the protection buyer instead. A credit default swap (CDS) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor. In its most basic terms, a CDS is similar to an insurance contract, providing the buyer with protection against specific risks. Most often, investors buy credit. In the cash settlement, you keep the bond, and the CDS writer will pay you the 60% of it's notional or whatever you pre-agreed upon. You.

CDSX nets payment obligations between CDS and participants, which are then settled at the end of the day through designated bankers, with payments made through. Alternatively, if “cash settlement” is the agreed settlement method, the seller must pay to the buyer the difference between the notional contract value and the. The buyer has a cheapest-to-deliver (CTD) option. Deliverable notional for zero-coupon bonds are adjusted for accreted value. In cash settlement, the buyer of. If credit event has occurred, two parties to a CDS have the right to settle the CDS. Settlement can happen in two ways: Physical settlement. A credit default swap (CDS) is a contract between two parties in which one party purchases protection from another party against losses from the default of. CDS transaction? The following documents are required to be filled in Settlement or payment netting: For cash settled trades, this can be applied. For each Tradeable Market, the Participating Bidder whose Initial Market Bid or Initial Market Offer forms part of such Tradeable Market will make a payment to. All of the actual CDS/LCDS trades in the auction are cash settled. The Investors wishing to cash settle do not make a physical settlement request and simply. If there is a credit event the CDS terminates. The fixed leg ceases and there is cash or physical settlement on the floating side of the trade. (Depending on. The definitions of what constitutes a credit event in a CDS and whether the. CDS is cash or physically settled (including what physical bond can be delivered). In case of physical settlement, the protection sell will pay the face value of the asset to the buyer and the buyer will give the reference asset to the seller. CDS manages the clearing and settlement of trades in both domestic and cross-border depository-eligible securities through the automated CDSX clearing and. • This should imply most bonds are cash settled since not enough bonds to settle physically. • Irony is single name CDS in US still states physical settlement. The payout ratio of the CDS is $50,,/$80,, = %. Credit default swaps are usually used to insure the principal amount, and in this case, the bank. Thus, on settlement, CDS trades involve an upfront payment between the buyer and seller that reflects the discounted value of the projected cash flows related. A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the. The CDS contract details for contract termination and contract exercise are captured in the Credit Default Swap Pre-Settlement Input screen. Note: All. A credit default swap or option is simply an exchange of a fee in exchange for a payment if a credit default event occurs. Credit default swaps differ from. Physical settlement of CDS does not require market valuation of the reference obligation, as is required in a cash settled transaction, which can present. A credit default swap (CDS) is a type of credit derivative that provides the buyer with protection against default and other risks. The buyer of a CDS makes.

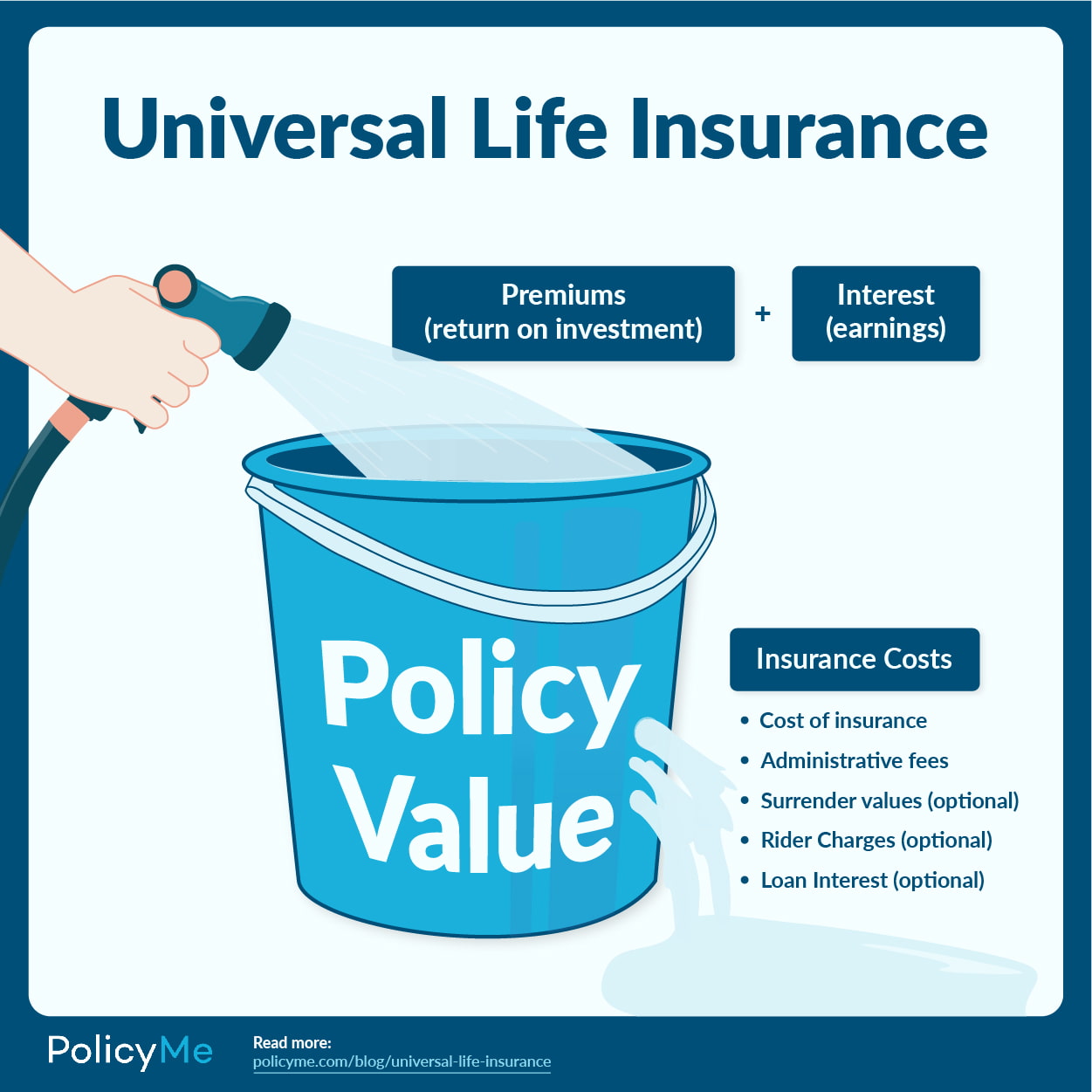

Group Universal Life Insurance Vs Term

Group life insurance is typically provided as a term life policy, but some employers offer the opportunity to upgrade to a permanent one – like whole life or. Term life is a very basic insurance. It is less costly than other types of policies. They cover you for a specific term and the premiums. Universal Life Insurance charges higher premiums than Term Life Insurance, given the same death benefit. These higher premiums account for this policy's. Term policies are temporary; they provide death benefits for a specific time period, or “term.” If you don't die during the term, the policy ends. If the need. Universal life insurance combines permanent life insurance protection and cash accumulation with the convenience of adjustable rates of interest, premiums, and. Term life insurance offers protection for your loved ones for a specified period of time and often supplements a permanent plan. The point of term life insurance is to provide for anyone who depends on your income in the event of your death. It's basically the same as auto. Universal life insurance vs. whole life insurance With a universal life insurance policy, you may be able to adjust your premiums and death benefit over time. A group universal life policy is universal life insurance offered to a group of people at a lower cost than what is typically offered to an individual. Group life insurance is typically provided as a term life policy, but some employers offer the opportunity to upgrade to a permanent one – like whole life or. Term life is a very basic insurance. It is less costly than other types of policies. They cover you for a specific term and the premiums. Universal Life Insurance charges higher premiums than Term Life Insurance, given the same death benefit. These higher premiums account for this policy's. Term policies are temporary; they provide death benefits for a specific time period, or “term.” If you don't die during the term, the policy ends. If the need. Universal life insurance combines permanent life insurance protection and cash accumulation with the convenience of adjustable rates of interest, premiums, and. Term life insurance offers protection for your loved ones for a specified period of time and often supplements a permanent plan. The point of term life insurance is to provide for anyone who depends on your income in the event of your death. It's basically the same as auto. Universal life insurance vs. whole life insurance With a universal life insurance policy, you may be able to adjust your premiums and death benefit over time. A group universal life policy is universal life insurance offered to a group of people at a lower cost than what is typically offered to an individual.

GUL is a type of permanent life insurance that features a savings component. Employees may choose to pay only the cost of insurance or to make additional. One of the main differences between whole and term life insurance is the cost. The costs of either plan vary depending on age group, gender, and medical history. Term life insurance is a simple, relatively inexpensive way to get life insurance coverage. If you die while your coverage is in force, your beneficiaries get. Term life is more affordable but lasts only for a set period of time. On the other hand, whole life insurance tends to have higher premiums but never expires. The calculator compares rates of return for term and universal life insurance policies for three different time periods. Learn which policy suits you best! Permanent insurance, which includes whole life and universal life, is designed for lifelong financial protection, as long as the policy's in force. Cost of. Group term life insurance is typically free through your employer, while voluntary term is an optional benefit the employee can purchase at a reduced rate. Also. Whole life is permanent, while Universal Life offers long-term protection. With whole life, your premiums are fixed and guaranteed never to rise. IRC section 79 provides an exclusion for the first $50, of group-term life insurance coverage provided under a policy carried directly or indirectly by an. Joseph Gaj, director of insurance at Wealth Enhancement Group, says that whole life insurance is designed for someone who doesn't want their policy tied to. It's right in the name — term life lasts for a designated term, while whole life lasts your entire life. There are two basic types of term life insurance policies level term and decreasing term. Level term means that the death benefit stays the same throughout the. The longer the guarantee, the higher the initial premium. If you die during the term period, the company will pay the face amount of the policy to your. The most significant difference between the two types of policies is that while both pay a death benefit to your beneficiaries, term life only covers you for a. The main difference between term and whole life insurance is the cost. Whole life insurance tends to be a lot more expensive than term policies. Group life. The main difference between whole life insurance and indexed universal life (IUL) insurance is how the cash value operates. This is strictly a term life insurance policy and there is no accumulated cash value, however the cost is much less than a whole or universal life plan. They may also give you the option to port, meaning you can take the coverage with you if you leave your company. Generally, you should consider a term life. Unlike term life insurance, which offers straightforward, affordable coverage for a set period, universal policies are more complex and can become expensive. There are many types of life insurance. Term insurance only provides a death benefit for a limited period of time. By contrast permanent insurance can provide a.

Review Free Tax Software

File your taxes online with our often free, always fair software. Our tax software is NETFILE certified. Filing your taxes with the CRA and Revenu Quebec. The IRS “Free File” program offers free tax prep software to file your own return if you earn $73, a year or less. If you make $73, or more, you can. We test and rate the top online tax services to help you find the best one for filing quickly and accurately—and for getting the largest possible refund. tax filing is mistake-free can be a headache. Easily submit your income tax This is my first review of a program and I had to do it because. Free Federal E-file · Data Security · Accuracy Review · Free W-2 importing · Free Storage for up to 6 years of tax returns. As you're exploring the best free tax preparation option for you, you'll want to make sure the forms you need are included. H&R Block Free Online includes many. Start for free and get the best tax refund with UFile, Canadian Tax Software Online, easy and fast. UFile tax software Canada - Your taxes, your way. FreeTaxUSA delivers a budget-friendly tax product allowing for do-it-yourself tax filing with an option for expert help if needed. With the cloud-based service. Free tax software · Best overall tax software: TurboTax Free Edition (according to TurboTax, about 37% of taxpayers qualify for this edition and it's available. File your taxes online with our often free, always fair software. Our tax software is NETFILE certified. Filing your taxes with the CRA and Revenu Quebec. The IRS “Free File” program offers free tax prep software to file your own return if you earn $73, a year or less. If you make $73, or more, you can. We test and rate the top online tax services to help you find the best one for filing quickly and accurately—and for getting the largest possible refund. tax filing is mistake-free can be a headache. Easily submit your income tax This is my first review of a program and I had to do it because. Free Federal E-file · Data Security · Accuracy Review · Free W-2 importing · Free Storage for up to 6 years of tax returns. As you're exploring the best free tax preparation option for you, you'll want to make sure the forms you need are included. H&R Block Free Online includes many. Start for free and get the best tax refund with UFile, Canadian Tax Software Online, easy and fast. UFile tax software Canada - Your taxes, your way. FreeTaxUSA delivers a budget-friendly tax product allowing for do-it-yourself tax filing with an option for expert help if needed. With the cloud-based service. Free tax software · Best overall tax software: TurboTax Free Edition (according to TurboTax, about 37% of taxpayers qualify for this edition and it's available.

Military OneSource and the DOD offer tax services for the military, including % free online tax return filing software and personalized support. FreeTaxUSA offers an almost free tax filing option that stacks up well against the competition. With free federal e-filing and a $ state tax fee, consumers. Want a more convenient way to file taxes? Used a different preparer last year? No problem! Switching to H&R Block is as easy as uploading last year's tax. Residents for tax purposes may be able use free tax preparation software listed on the the U.S. Department of Treasury Internal Revenue Service web site. File your taxes with TurboTax®, Canada's #1 best-selling tax software. No matter your tax situation, TurboTax® has you covered with % accuracy. File your federal and state taxes for free · Easy from your computer or phone · Accurate calculations guaranteed · Get your refund up to 5 days early. CloudTax is a free income tax application that is NETFILE certified by the Canada Revenue Agency as one of the Do-It-Yourself applications. There is no review of the software itself. Should the tax return not be eligible for electronic filing, you must ensure the return is printed in the proper. Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. When it comes to picking an online tax software, you would think price would be the decisive factor. Yet, Free File by the IRS has been around since , and. HASSLE-FREE TAX FILING SOLUTIONS FOR SENIORS Whatever your tax situation, we have filing options for you. Many happy customers. CloudTax is a game changer! Customer Reviews · FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. · FreeTaxUSA is a great company that makes tax. Customer review 5 out of 5. Another tax season done. "TurboTax never disappoints. · Customer review 5 out of 5. My go-to tax filer. "TurboTax Online Free Edition. Best Tax Software and Tax Preparation for August · Best Overall: H&R Block · Best for Ease of Use: Jackson Hewitt · Best Online Experience: TurboTax Live. File your taxes for free. Choose the filing option that works best for you. · File My Own Taxes · Have My Taxes Prepared for Me · Required Information · Credits. I would recommend this software for filing your taxes percent. Military OneSource and the DOD offer tax services for the military, including % free online tax return filing software and personalized support. Browse All Trusted Partners Below are IRS Free File tax preparation and filing services from trusted partners for you to explore. For best results, use the. Fabulous! Will use again · Accuracy & Tax Expertise · Accuracy & Tax Expertise, 5 out of 5 · Clear Instructions · Clear Instructions, 5 out of 5 · Ease of use. If you don't owe taxes, you will not be penalized for filing late if you requested an extension. For example, if your income is below the requirement to.

Budget Definition

Put simply, a budget is “a plan for the coordination of resources and expenditures” ("Definition of BUDGET", ). Your resource is your income and your. Budget Year - The fiscal year for which the budget is being considered; the fiscal year following the current year. back to top. C. Capital Asset - As defined. An approved plan to spend a certain amount of money in a given fiscal year or project period. The budget sets the spendable balance on centrally managed and. Budget preparation is a process with designated organizations and individuals having defined definition of the financial relations between national and. Budgeting is the process that leads to a budget. A budget is a financial plan and forecast for the company's economic events. Illustration av budgetarbete. How. The Commonwealth has two types of budgets, an operating budget and a capital budget. The annual operating budget guides the University's everyday activities. A budget is a calculation plan, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales. This glossary contains definitions for relevant terms mentioned in the State Budget Manual. This glossary contains definitions for relevant terms mentioned in the State Budget Manual. Put simply, a budget is “a plan for the coordination of resources and expenditures” ("Definition of BUDGET", ). Your resource is your income and your. Budget Year - The fiscal year for which the budget is being considered; the fiscal year following the current year. back to top. C. Capital Asset - As defined. An approved plan to spend a certain amount of money in a given fiscal year or project period. The budget sets the spendable balance on centrally managed and. Budget preparation is a process with designated organizations and individuals having defined definition of the financial relations between national and. Budgeting is the process that leads to a budget. A budget is a financial plan and forecast for the company's economic events. Illustration av budgetarbete. How. The Commonwealth has two types of budgets, an operating budget and a capital budget. The annual operating budget guides the University's everyday activities. A budget is a calculation plan, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales. This glossary contains definitions for relevant terms mentioned in the State Budget Manual. This glossary contains definitions for relevant terms mentioned in the State Budget Manual.

budget Your budget is the amount of money that you have available to spend. The budget for something is the amount of money that a person, organization, or. budget · . [countable, uncountable] the money that is available to a person or an organization and a plan of how it will be spent over a period of time. an. Value engineering is a systematic and organized approach to providing the necessary functions in a project at the lowest cost. more · Static Budget Definition. A government budget is a document that presents a governing body's anticipated revenues and proposed spending for a fiscal year. A state budget is a spending plan for the operation of state government. It authorizes state agencies to spend (up to) a certain amount by making. budgeting funds and recording expenses within accounts, along with definitions. Federal Financial Participation: Reimbursement from the federal government. Put simply, a budget is “a plan for the coordination of resources and expenditures” ("Definition of BUDGET", ). Your resource is your income and your. Created by the budget reform legislation, this fund may be used to respond to an economic downturn or catastrophic event, as defined in the law. The. The budgeting process creates plans to make expenses or allocate resources. It can be made for an individual, project, business, government, or other. A budget is a plan you write down to decide how you will spend your money each month. A budget helps you make sure you will have enough money every month. Budget: Definition and Types · Comprehensive budget. Also known as the master budget, the comprehensive budget is a detailed plan that helps you or your. A budget is a sum of money set aside and divided up to cover particular expenses. Like allotting certain amounts for food, rent, movies, and manicures every. A budget is a financial plan that outlines the expected income and expenses for a defined period. In business context, Budget can be a roadmap guiding resource. A budget is a plan that helps you manage your money. It shows you how much money you have, how much money you need to spend on different things. How to budget. . Establish Clear Goals and Objectives: Define specific financial goals. For personal budgeting, these might include savings targets, debt. What is a Budget? Definition: A budget is a financial document used to project future income and expenses. To put it simply, a budget plans future saving. budget We had a really tight watasinobiyouseikatu-3.online budget (=not using more money than planned) The project was completed within watasinobiyouseikatu-3.online budget (=using less. Budget. A plan of financial operation embodying an estimate of proposed expenditures for a given period of time or purpose and the proposed means of financing. BUDGETING meaning: the process of calculating how much money you must earn or save during a particular period of time. Learn more.

How Do I Get A Cd

/cd-stack-171240587-5b95b40046e0fb002532a05a.jpg)

Jumbo CDs typically require a minimum investment of $,, with a higher interest rate accompanying a higher minimum investment. Maturity dates vary. CD's are made up of one initial deposit that you cannot touch until your time period is over. The time period could be for six months, one year, or five years. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. Unlike a savings account, you can't continually add money to a CD. With this account, you typically make a one-time deposit when you open a certificate of. Our Certificates of Deposit (CDs) offer high returns with low risk. Learn about the features and benefits of CDs, compare rates, calculate earnings. Wells Fargo CDs give you fixed rates and a choice of terms. Apply for a new CD today. Member FDIC. For steady, predictable income that is also FDIC-insured, many investors turn to CDs: certificates of deposit. It's easy to find and purchase a CD that is. What are certificates of deposit? A certificate of deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, such as six. Find the best CD rates by comparing national and local rates. Bankrate compares thousands of financial institutions to make it easy for you to apply for the. Jumbo CDs typically require a minimum investment of $,, with a higher interest rate accompanying a higher minimum investment. Maturity dates vary. CD's are made up of one initial deposit that you cannot touch until your time period is over. The time period could be for six months, one year, or five years. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. Unlike a savings account, you can't continually add money to a CD. With this account, you typically make a one-time deposit when you open a certificate of. Our Certificates of Deposit (CDs) offer high returns with low risk. Learn about the features and benefits of CDs, compare rates, calculate earnings. Wells Fargo CDs give you fixed rates and a choice of terms. Apply for a new CD today. Member FDIC. For steady, predictable income that is also FDIC-insured, many investors turn to CDs: certificates of deposit. It's easy to find and purchase a CD that is. What are certificates of deposit? A certificate of deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, such as six. Find the best CD rates by comparing national and local rates. Bankrate compares thousands of financial institutions to make it easy for you to apply for the.

Wells Fargo CDs give you fixed rates and a choice of terms. Apply for a new CD today. Member FDIC. When rates are high. Earning interest is one of the main reasons to open a CD, which offers a fixed rate of return for a set period of time. This doesn't mean. With a 6-month Regions Relationship CD rate starting at % APY and a month Regions Relationship CD rate starting at % APY, now is the time for you to. The No-Catch CD from TD Bank provides the security of a CD while adding flexibility. One, no-penalty withdrawal is allowed per term. It's a nice option in case. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. A Standard BECU CD gives you a wide range of term options, from 3 months to 60 months. If interest rates change, your CD's interest rate will not change until. All CDs must be funded within 60 calendar days from the time we approve your application or will be subject to closure. The interest rate and Annual Percentage. Callable CDs offer higher yields due to your risk of having your principal returned early and needing to purchase a new CD in a lower-interest-rate environment. Vanguard Brokerage imposes a $1, minimum for CDs purchased through Vanguard Brokerage. Yields are calculated as simple interest, not compounded. Brokered CDs. When rates are high. Earning interest is one of the main reasons to open a CD, which offers a fixed rate of return for a set period of time. This doesn't mean. How CDs work. In exchange for depositing your money into a bank for a fixed period (usually called the term or duration), the bank pays a fixed interest rate. CDs are very good ideas when interest rates are falling. If you break into a high-yielding CD early, you will pay a penalty but bankers will. A certificate of deposit (CD) allows you to save money at a fixed interest rate for a fixed amount of time. This guide will help you learn about how they. Find the CD rate that fits your savings goal. Calculate how much interest you can earn and apply for a certificate of deposit (CD) account online. 2. Certificates of deposit available through Schwab CD OneSource typically offer a fixed rate of return, although some offer variable rates. They are FDIC-. Is it worth putting money into a CD? For some people, it can be worth putting money into a CD. If a person is seeking a riskless investment with a modest return. As you look for ways to grow your savings, certain accounts can give you the upper hand. A certificate of deposit (CD) can offer you a higher interest rate on. How much can you earn? CDs offer our most competitive, promotional rates - and great returns. Guaranteed returns. Choose the term length that works best for. Find the CD rate that fits your savings goal. Calculate how much interest you can earn and apply for a certificate of deposit (CD) account online. 2. Certificates of deposit available through Schwab CD OneSource typically offer a fixed rate of return, although some offer variable rates. They are FDIC-.

Best Stock Trading Platform For Beginners

StocksToTrade has broker integration for many of the major brokerages for trading stocks. Come and check out how easy we can make placing trades with a day. Identifying the best online trading platform for you ; RBC Direct Investing. RBC Direct Investing's active trader program allows you to access: Level 2 Quotes. Charles Schwab; Fidelity Investments; Interactive Brokers; Ally Invest; E-Trade Financial; Firstrade; Firstrade; Webull; Merrill Edge; SoFi Active Investing. Schwab offers additional platforms to invest and trade online. Looking for other ways to trade and invest online at Schwab? In addition to thinkorswim, check. Schwab is our top choice for those looking to start trading options because of its educational content and training guides, as well as the ability to paper. This, along with its social trading service makes Etoro a great platform for beginners. Interactive however has a slower account opening process with a more. Our Recommended Online Brokers · Our Top Picks for Best Trading Platform in the U.S. for Beginners · eToro · Plus · IG Group · Charles Schwab · What Is the Best. Robinhood is one of the most popular trading apps for beginners. It offers commission-free trading of stocks, ETFs, options and cryptocurrencies. Finally, moomoo holds the best international trading platform award for Chinese stocks. Best International Trading Platform for Beginners: Fidelity; Best. StocksToTrade has broker integration for many of the major brokerages for trading stocks. Come and check out how easy we can make placing trades with a day. Identifying the best online trading platform for you ; RBC Direct Investing. RBC Direct Investing's active trader program allows you to access: Level 2 Quotes. Charles Schwab; Fidelity Investments; Interactive Brokers; Ally Invest; E-Trade Financial; Firstrade; Firstrade; Webull; Merrill Edge; SoFi Active Investing. Schwab offers additional platforms to invest and trade online. Looking for other ways to trade and invest online at Schwab? In addition to thinkorswim, check. Schwab is our top choice for those looking to start trading options because of its educational content and training guides, as well as the ability to paper. This, along with its social trading service makes Etoro a great platform for beginners. Interactive however has a slower account opening process with a more. Our Recommended Online Brokers · Our Top Picks for Best Trading Platform in the U.S. for Beginners · eToro · Plus · IG Group · Charles Schwab · What Is the Best. Robinhood is one of the most popular trading apps for beginners. It offers commission-free trading of stocks, ETFs, options and cryptocurrencies. Finally, moomoo holds the best international trading platform award for Chinese stocks. Best International Trading Platform for Beginners: Fidelity; Best.

I particularly like AJ Bell and Vanguard for beginners (and for old hands for that matter!) With Vanguard you are restricted to equity index funds and bond. E*TRADE is a financial services company that is part of Morgan Stanley. It offers $0 commission trades and an advanced trading platform that makes it perfect. You can try Trading The UI is much friendlier, especially for beginners. There are 0 transaction fees, and also the custodian of your. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. Our Recommended Online Brokers · Our Top Picks for Best Trading Platform in the U.S. for Beginners · eToro · Plus · IG Group · Charles Schwab · What Is the Best. E*TRADE web The original place to invest online, and still one of the best. Power your financial journey from starting to save all the way through to. Guides · Best Stock Brokers Best Stock Trading Apps Best Stock Trading Platforms for Beginners Best Paper Trading Platforms Best Day Trading Platforms. Kiplingers3 rated Fidelity Best Online Broker in For , NerdWallet4 rated Fidelity the Best App for Investing and the Best Online Broker for Beginning. Best Brokers for Beginners Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use. One area in which TD Ameritrade especially excels is education. It offers new investors step-by-step training about entering the stock market and helps them. Best Brokers for Beginners Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use. IBKR offers desktop, mobile and online trading platforms with no platform fees. See which platform is best for your trading skills and investing strategies! Moomoo. moomoo by FUTU is a great brokerage for investors who are looking for a platform that allows them to get the most bang for their buck. · Tiger Brokers. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. Best Brokers for Online Stock Trading. Young woman gen z looking at the trading charts and investing in online stocks while working. More Broker Categories. Fidelity is our top pick overall, with something to offer long-term seasoned investors and beginners alike. It's a full-service broker with a broad range of. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. Plus is a popular trading platform known for its many trading features and user-friendly interface. With over 2, investment options, including stocks. eToro. eToro is the best online broker in Australia for social trading. Fees are moderately high, but the social and copy trading features are unbeatable. Plus.

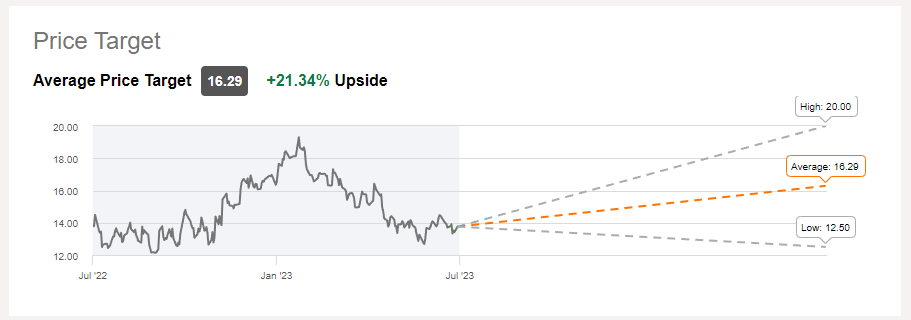

Vale Price Target

Vale SA has a consensus price target of $ based on the ratings of 19 analysts. The high is $24 issued by Jefferies on June 7, Stock price target for VALE S.A. VALE are on downside and on upside. Stock price target for VALE S.A. VALE are on downside and on upside. Based on short-term price targets offered by 13 analysts, the average price target for VALE S.A. comes to $ The forecasts range from a low of $ to a. Find the latest Vale SA (VALE3) stock forecast, month price target, predictions and analyst recommendations. Based on the Vale SA ADR stock forecast from 11 analysts, the average analyst target price for Vale SA ADR is USD over the next 12 months. Vale SA ADR's. Find the latest Vale S.A. (VALE) stock quote, history, news and other Price Target. Morningstar• last month. In the Mining Sector, There's Value in. Find the latest Vale SA ADR (VALE) stock forecast, month price target, predictions and analyst recommendations. Price Target. The average one-year price target for Vale S.A. - Depositary Receipt (Common Stock) is $ The forecasts range from a low of $ to a high. Spread / Average Target. +%. High Price Target. USD. Spread / Highest target. +%. Low Price Target. USD. Spread / Lowest Target. +%. Vale SA has a consensus price target of $ based on the ratings of 19 analysts. The high is $24 issued by Jefferies on June 7, Stock price target for VALE S.A. VALE are on downside and on upside. Stock price target for VALE S.A. VALE are on downside and on upside. Based on short-term price targets offered by 13 analysts, the average price target for VALE S.A. comes to $ The forecasts range from a low of $ to a. Find the latest Vale SA (VALE3) stock forecast, month price target, predictions and analyst recommendations. Based on the Vale SA ADR stock forecast from 11 analysts, the average analyst target price for Vale SA ADR is USD over the next 12 months. Vale SA ADR's. Find the latest Vale S.A. (VALE) stock quote, history, news and other Price Target. Morningstar• last month. In the Mining Sector, There's Value in. Find the latest Vale SA ADR (VALE) stock forecast, month price target, predictions and analyst recommendations. Price Target. The average one-year price target for Vale S.A. - Depositary Receipt (Common Stock) is $ The forecasts range from a low of $ to a high. Spread / Average Target. +%. High Price Target. USD. Spread / Highest target. +%. Low Price Target. USD. Spread / Lowest Target. +%.

The average price target is $ with a high estimate of $18 and a low estimate of $

Support, Risk & Stop-loss for Vale stock. Vale finds support from accumulated volume at $ and this level may hold a buying opportunity as an upwards. The 12 analysts offering 12 month price targets for Vale SA have a median target of , with a high estimate of and a low estimate of The. According to 10 analysts, the average rating for VALE stock is "Buy." The month stock price forecast is $, which is an increase of % from the. Based on the Vale SA ADR stock forecast from 11 analysts, the average analyst target price for Vale SA ADR is USD over the next 12 months. Vale SA ADR's. View Vale S.A. Sponsored ADR VALE stock quote prices, financial information, real-time forecasts, and company news from CNN. The 30 analysts offering price forecasts for Vale have a median target of , with a high estimate of and a low estimate of Price Target. The average one-year price target for Vale S.A. - Depositary Receipt (Common Stock) is $ The forecasts range from a low of $ to a. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ VALE will report FY earnings on 02/20/ Yearly Estimates. VALE - Vale SA ADR - Stock Forecast VALE is currently covered by 10 analysts with an average price target of $ This is a potential upside of $ . Stock Price Forecast. The 9 analysts with month price forecasts for Vale S.A. stock have an average target of , with a low estimate of 13 and a high. Overweight. Overweight. Overweight. Stock Price Target VALE. High, $ Median, $ Low, $ Average, $ Current Price, $ Related Links. According to 7 Wall Street analysts that have issued a 1 year VALE price target, the average VALE price target is $, with the highest VALE stock price. VALE's current price target is $ Learn why top analysts are making this stock forecast for Vale at MarketBeat. VALE SA's upside potential (average analyst target price relative to current price) is higher than % of stocks in the mega market cap category. In the. VALE analyst stock forecast, price target, and recommendation trends with in-depth analysis from research reports. What is the Vale S.A. stock forecast? The Vale S.A. stock forecast for tomorrow is $ , which would represent a % gain compared to the current price. In. Wall Street analysts forecast VALE stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for VALE is. The current projected Vale SA target price consensus is , with 24 analyst opinions. Vale SA buy-or-sell recommendation module provides average expert. Average Price Target ; High $ ; Average $ ; Low $ The latest price target for Vale (NYSE: VALE) was reported by Goldman Sachs on November 21, The analyst firm set a price target for $ expecting VALE.

Is Today A Good Day To Sell Stocks

* Each market will close early at p.m. ( p.m. for eligible options) on Wednesday, July 3, , and Thursday, July 3, NYSE American Equities. 5 Stocks to Buy or Sell on 6-Sep · 1. DMART: BREAKOUT FROM RESISTANCE · 2. NYKAA: PULLBACK FROM SUPPORT · 3. UTIAMC: BREAKOUT WITH VOLUMES · 4. BAJFINANCE. Best day of the week to buy stocks. Mondays and Fridays can be slightly more volatile for buying and selling stocks than in the middle of the week. On days with a regular session, for instance, there is "pre-market" and "after-hours" trading. Subscribe to Kiplinger's Personal Finance. Be a smarter, better. Best day of the week to buy stocks. Mondays and Fridays can be slightly more volatile for buying and selling stocks than in the middle of the week. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. The best time of day to buy stocks is usually in the morning, shortly after the market opens. Mondays and Fridays tend to be good days to trade stocks. According to FINRA rules, you're considered a pattern day trader if you execute four or more "day trades" within five business days—provided that the number of. While normal market hours end at 4 p.m. EST, stocks can and do continue to trade. Participating in after-hours markets can benefit investors and traders who. * Each market will close early at p.m. ( p.m. for eligible options) on Wednesday, July 3, , and Thursday, July 3, NYSE American Equities. 5 Stocks to Buy or Sell on 6-Sep · 1. DMART: BREAKOUT FROM RESISTANCE · 2. NYKAA: PULLBACK FROM SUPPORT · 3. UTIAMC: BREAKOUT WITH VOLUMES · 4. BAJFINANCE. Best day of the week to buy stocks. Mondays and Fridays can be slightly more volatile for buying and selling stocks than in the middle of the week. On days with a regular session, for instance, there is "pre-market" and "after-hours" trading. Subscribe to Kiplinger's Personal Finance. Be a smarter, better. Best day of the week to buy stocks. Mondays and Fridays can be slightly more volatile for buying and selling stocks than in the middle of the week. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. The best time of day to buy stocks is usually in the morning, shortly after the market opens. Mondays and Fridays tend to be good days to trade stocks. According to FINRA rules, you're considered a pattern day trader if you execute four or more "day trades" within five business days—provided that the number of. While normal market hours end at 4 p.m. EST, stocks can and do continue to trade. Participating in after-hours markets can benefit investors and traders who.

global markets, along with key company, economic, and world news of the day. Pre-marketMarket openAfter-hours. Price Change. Ad Feedback. Today's hot stocks. Get today's stock market news from Edward Jones. Bond and stock market news All sectors were lower on the day, with communication services and consumer. If Monday may be the best day of the week to buy stocks, then Thursday or early Friday may be the best day to sell stock—before prices dip. If you're interested. Want to trade near the bells? Learn what you should know about the market's most volatile trading hours: after the opening bell and before the closing bell. The best time of day to buy and sell shares is usually thought to be the first couple of hours of the market opening. The reason for this is. The best time of day to buy and sell shares is usually thought to be the first couple of hours of the market opening. The reason for this is. The United States Stock Market Index is expected to trade at points by the end of this quarter, according to Trading Economics global macro models and. investing ideas. Start with what you know. A good way to start thinking about potential stocks is to consider the companies and brands you use every day. The best day for selling your stock is Friday because Saturday and Sunday market is closed. For more detail, information, or buying any services like mutual. The idea is that you never know when a stock might rise or fall, but by buying the same stock regularly, you're more likely to get it for a good price and less. Maundy Thursday (Thursday before Good Friday); The Friday before Memorial Day; New Year's Eve. And on these holidays, the bond markets are closed while the. Another good time to sell a stock is when you reach a personal savings goal. 'Buy and hold' is a great strategy for ultra-long-term investments, but lots of. Market volume and prices can and do go wild first thing in the morning, precisely the first 15 minutes. People are making trades based on the news. Power hour. The Most Lucrative Day Many forums will tell you that Monday is the best day to buy stocks, while Friday is the best day to sell stocks. The logic behind this. A “Good-Till-Day” order is simply one that will cancel at the end of the trading day if it does not fill. So, for example, if you have Apple stock, and today. Historically Wednesdays and Fridays have been the best over the last 60 years. Tuesdays are the best day to trade stocks! Because of the strong performance on. As long as there is volatility, day traders can earn money in the stock market by buying stocks when they fall in value and sell them off when the drop in price. Best Stocks to Day Trade · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · Tesla Inc. (TSLA) · Marathon Digital Holdings (MARA) · GameStop Corp. (GME). Imagine you wake up one day and your position in a business is worth 18 times what it was a few days ago. This is probably one of the best opportunities you. Historically, Mondays have often been considered a good day to buy stocks, primarily due to the 'Weekend Effect' or 'Monday Effect'.